Recommended Blog Posts

- Super Visa Income Requirements 2025-26 | Updated LICO Table & Eligibility Guide

- Is Express Entry or PNP Better for You? New Immigrations Targets Are Announced For 2026

- Canada Super Visa vs. PGP: Which Path is Faster for Parent Reunification?

- Eligibility for Canada Pension Plan (CPP) and Old Age Security (OAS)

- Spousal Sponsorship Canada 2026 – New Rules, Processing Time & How to Apply

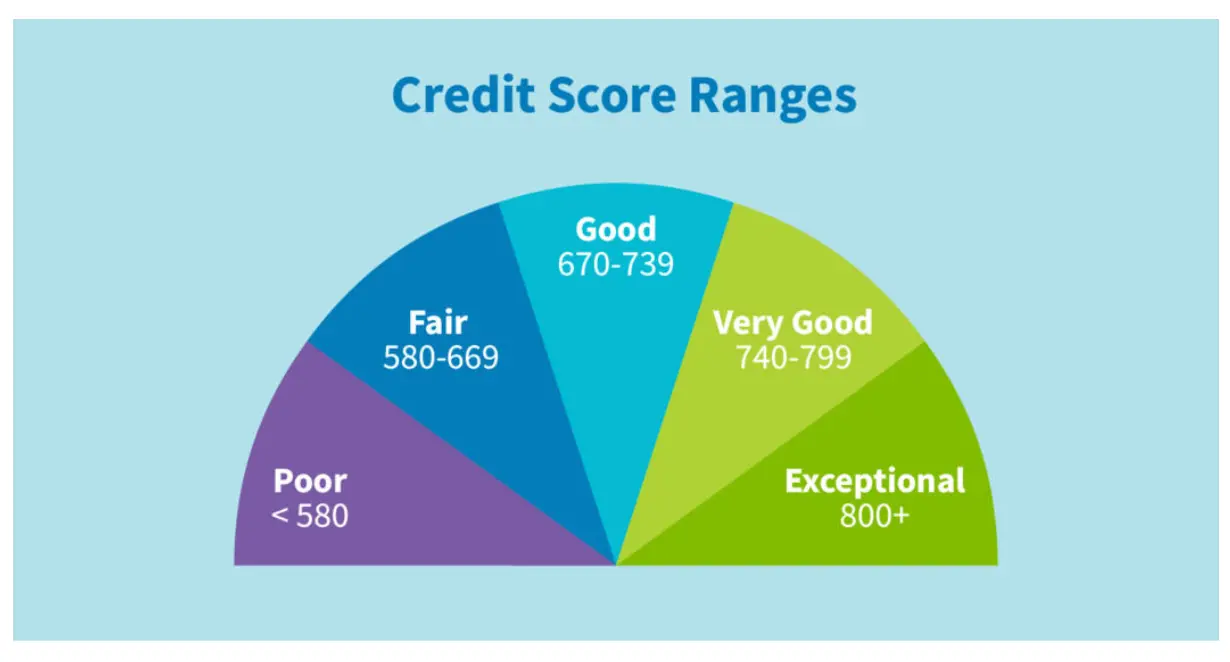

Why a Good Credit Score Becomes Essential After Your ITA and Landing in Canada (Preparing for 2026)

Last Updated On: January 31, 2026Many applicants search “credit score for Canada PR” because they assume immigration works like a bank loan decision.

In reality, Canada PR programs do not set a minimum credit score requirement. What matters is whether you meet program eligibility (like work experience, language, education), financial requirements where applicable (for example, settlement funds in some Express Entry programs), and admissibility (security/criminal/medical).

The confusion usually comes from this overlap: IRCC may ask for financial documents that mention debts, but that is not the same as pulling your credit report or requiring a specific score.

Why People Search “Credit Score For Canada PR”

Most international applicants come from countries where:

-

Visa officers may scrutinize financial stability heavily, and/or

-

Banks and landlords require a strong credit score for approvals

In Canada, credit score is mainly a lending and renting tool after you arrive—not a PR eligibility metric for most pathways. The immigration system focuses on documents like proof of funds, income, sponsorship eligibility, and debts you disclose in required financial letters.

Does IRCC Check Your Credit Score For PR?

For several PR pathways, IRCC asks you to provide proof of funds, which must be supported by bank letters and statements. Those bank letters must include details like:

-

account balances

-

average balance

-

outstanding debts such as credit card debts and loans.

That debt information comes from your bank letter—not from IRCC running a credit bureau check.

What IRCC Does Not List As A Requirement

IRCC’s PR program pages (Express Entry programs, sponsorship programs) describe requirements such as:

-

education, language, work experience

-

settlement funds (when required)

-

sponsorship eligibility rules (for family class)

-

admissibility criteria

They do not list “minimum credit score” as a PR requirement.

Practical conclusion: If you have no credit history or no Canadian credit score, you can still qualify for PR—because PR eligibility is not built on credit scoring.

Where Finances Matter For Canada PR

Here’s the clean way to explain it to applicants:

“Credit Score” vs “Financial Requirements” In Common PR Pathways

| PR Pathway | Is A Credit Score Required? | What Financial Proof Actually Matters |

|---|---|---|

| Express Entry – FSW / FST | No | Settlement funds (proof of funds) are required unless exempt. |

| Express Entry – Canadian Experience Class | No | IRCC states CEC applicants don’t need proof of funds. |

| Family Sponsorship (spouse/partner/child) | No | Sponsor must be eligible (not in default of loans/undertakings; not bankrupt in certain cases; etc.). |

| Parents & Grandparents Sponsorship | No | Sponsor eligibility rules include not being behind on specific debts and other ineligibilities. |

Credit score is not a PR eligibility requirement, but your financial documents and debt obligations can affect how credible and complete your application looks—especially for programs requiring proof of funds or sponsorship eligibility.

Why IRCC Asks For “Outstanding Debts” In The Bank Letter

IRCC requires the bank letter to list your outstanding debts (credit cards, loans).

This is primarily to help officers assess:

-

Whether funds shown are realistic and accessible

-

Whether the applicant’s financial story is consistent

-

Whether the bank documentation is complete and verifiable

It still does not mean IRCC is checking your credit score. It means IRCC is checking your proof of funds and banking credibility.

Can Bad Credit Or Debt Refuse A Canada PR Application?

Most Common Reality

For Express Entry applicants, refusal risk usually comes from:

-

not meeting eligibility,

-

weak/incomplete proof of funds,

-

documentation inconsistencies,

-

misrepresentation.

A “bad credit score” is not normally the refusal reason—because it isn’t a standard PR requirement.

Where Debt Can Create Indirect Risk

Debt becomes a problem when:

-

your settlement funds look borrowed or unstable (IRCC prohibits borrowing settlement funds),

-

your bank letter shows large liabilities and you cannot still show required liquid funds,

-

you’re a sponsor who is in default of an immigration loan, undertaking, or support payments, which can make you ineligible to sponsor.

So the accurate way to explain it is:

Debt doesn’t automatically refuse PR, but debt can weaken financial proof or sponsor eligibility if it affects required funds or default status.

Sponsorship Cases: Financial “Defaults” Matter More Than Credit Score

IRCC’s sponsorship guides clearly list situations where a sponsor may be ineligible, such as being:

-

behind on immigration loan payments

-

in default of a previous undertaking

-

behind on court-ordered family support payments

-

undischarged bankrupt (in certain cases)

This is not a credit score check. It’s an eligibility rule tied to sponsor responsibilities and previous financial obligations to the government or family support system.

Newcomers: Credit Score Starts After You Arrive

A big SEO opportunity is addressing the second question behind the keyword:

“Do I need a credit score to immigrate?” and “How do I build credit after PR?”

Official Credit Basics (Government of Canada)

The Financial Consumer Agency of Canada explains:

-

how to get your credit report/score,

-

how long information can stay on your credit report,

-

and that secured credit cards can be an option for newcomers with no credit history.

Credit history is usually built through:

-

credit cards

-

phone/internet plans (depending on provider)

-

loans and payment history

Mention The Two Main Credit Bureaus

Canada’s two major bureaus are Equifax and TransUnion, and the Government of Canada explains ways to access your credit report.

Practical Checklist: What To Tell An Applicant Asking “What Credit Score Do I Need For PR?”

Use this exact script (professional + accurate):

-

No minimum credit score is required for Canada PR.

-

IRCC focuses on eligibility and admissibility, not your credit score.

-

If your PR pathway requires proof of funds, you must show liquid, accessible money and submit a bank letter that includes balances and outstanding debts.

-

If you’re applying through CEC, proof of funds is not required (unless IRCC invites you under a different Express Entry program).

-

If you’re sponsoring family, financial defaults (immigration loans/undertakings/support payments) can make you ineligible—separate from credit score.