Recommended Blog Posts

- Is Express Entry or PNP Better for You? New Immigrations Targets Are Announced For 2026

- Super Visa Income Requirements 2025-26 | Updated LICO Table & Eligibility Guide

- Canada Super Visa vs. PGP: Which Path is Faster for Parent Reunification?

- Visitor Visa vs. eTA: Which One Should You Apply for to Watch Canada FIFA World Cup 2026?

- Why a Good Credit Score Becomes Essential After Your ITA and Landing in Canada (Preparing for 2026)

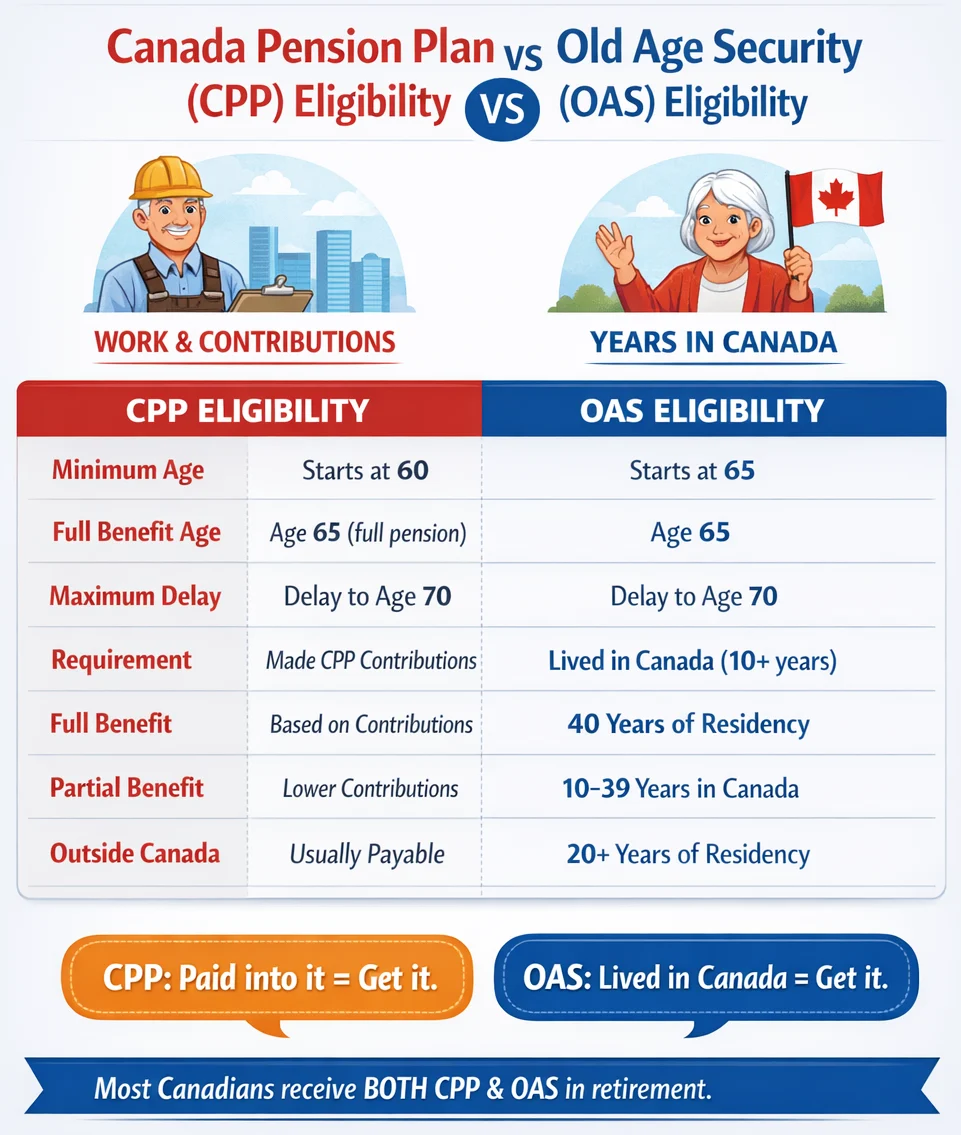

Eligibility for Canada Pension Plan (CPP) and Old Age Security (OAS)

Last Updated On: January 28, 2026Planning for retirement in Canada involves understanding two foundational government pension programs: the Canada Pension Plan (CPP) and Old Age Security (OAS). These programs form the backbone of retirement income for millions of Canadians, providing predictable monthly payments that help cover living expenses during your golden years.

However, eligibility requirements, payment amounts, and application processes differ significantly between the two programs.

Understanding The Difference Between CPP And OAS

Before diving into eligibility requirements, it's essential to understand how these two programs differ fundamentally.

Canada Pension Plan is a contributory pension program, meaning you must contribute to it during your working years to receive benefits later. Think of CPP as a government-administered retirement savings plan where you and your employer both contribute a percentage of your earnings. Your eventual CPP payment depends on how much and how long you contributed during your career.

Old Age Security, in contrast, is a non-contributory program funded through general tax revenues. You don't need to have worked or contributed anything to receive OAS—eligibility is based primarily on age and how long you've lived in Canada as a legal resident. This fundamental difference means almost all Canadian seniors can access OAS, while CPP benefits vary widely based on individual work history.

Canada Pension Plan (CPP) Eligibility Requirements

To qualify for CPP retirement benefits in 2026, you must meet specific criteria that center around age, contributions, and residency.

Age Requirements

You can begin receiving your CPP retirement pension as early as age 60, though this comes with permanent reductions to your monthly payment. The standard retirement age is 65, when you receive the full amount you've earned based on your contributions. You can also delay taking CPP until age 70, which increases your monthly payment substantially.

Here's how age affects your CPP amount: taking CPP at age 60 reduces your monthly payment by 36% compared to waiting until 65. Each month you take it early results in a 0.6% reduction.

Conversely, delaying CPP past 65 increases your payment by 0.7% per month, up to a maximum 42% increase if you wait until 70.

For 2026, the maximum CPP retirement benefit at age 65 is approximately $1,433 per month.

Contribution Requirements

You must have made at least one valid contribution to the CPP during your working years. A valid contribution comes from earning employment or self-employment income in Canada above the minimum threshold ($3,500 annually) or from receiving credits from a former spouse or common-law partner after a relationship ends.

Your CPP contributions are calculated based on your pensionable earnings—the portion of your annual income between $3,500 and the yearly maximum pensionable earnings.

For 2026, the earnings ceiling is $74,600. The contribution rate is 11.9% total (5.95% from you and 5.95% from your employer, or the full 11.9% if you're self-employed).

Work After Age 60

If you're working while receiving CPP before age 70, you can still contribute and earn CPP post-retirement benefits. These additional contributions create a separate benefit payment that increases your retirement income annually. Contributions become optional if you're under 65 and receiving CPP, but mandatory if you're between 65 and 70 and working. At age 70, contributions stop entirely, even if you continue working.

Quebec Exception

Quebec operates its own Quebec Pension Plan (QPP) with similar eligibility requirements and benefits. If you've worked in both Quebec and other provinces, the CPP and QPP coordinate to ensure you receive appropriate benefits from both programs.

Old Age Security (OAS) Eligibility Requirements

OAS has different eligibility criteria focused on age and residency rather than work history or contributions.

Age Requirements

You must be at least 65 years old to receive OAS payments. Unlike CPP, you cannot take OAS early. However, you can defer your OAS pension for up to five years (until age 70) in exchange for higher monthly payments. Each month you delay increases your pension by 0.6%, resulting in up to 36% more at age 70.

For January to March 2026, the maximum OAS payment is $742.31 monthly for seniors aged 65 to 74, and $816.54 for those 75 and older. This 10% increase for seniors 75+ was introduced to help older Canadians facing higher healthcare and living costs.

Residency Requirements For Canadian Residents

If you currently live in Canada, you must meet these requirements:

Legal Status: You must be a Canadian citizen or legal resident of Canada when your OAS application is approved. Permanent residents qualify, but visitors and temporary residents typically do not.

Residency Duration: You must have lived in Canada for at least 10 years after turning 18. This is the minimum to receive any OAS benefits while living in Canada.

Full vs. Partial OAS: To receive the full OAS pension, you need 40 years of Canadian residency after age 18. If you have between 10 and 40 years of residence, you'll receive a partial pension calculated as 1/40th of the full amount for each complete year lived in Canada.

Application Process And Timing

Understanding when and how to apply for these benefits ensures you receive payments without unnecessary delays.

CPP Application

CPP retirement pension is not automatic—you must apply. You can apply online through your My Service Canada Account, by mail using paper forms, or in person at a Service Canada office.

Required Information: Your Social Insurance Number, birth certificate, banking information for direct deposit, and details about your work history. If you've ever received CPP disability benefits or other CPP payments, you'll need that information as well.

Processing Time: Most CPP applications are processed within 120 days, though simple applications may be faster.

OAS Application

Many Canadians are automatically enrolled for OAS. Service Canada identifies eligible individuals using information from tax returns and immigration records, then sends an enrollment letter the month after you turn 64.

If you don't receive an automatic enrollment letter within one month of turning 64, you need to apply manually. Applications can be submitted online through My Service Canada Account or by mailing a paper application.

Important: If you're living outside Canada, you must use a paper application and mail it to the Service Canada office in your last province or territory of residence. Start the application process at least six months before you want payments to begin.

When Payments Start: If you're automatically enrolled, payments typically begin the month after your 65th birthday. If you apply manually, payments can start the month after you meet all eligibility requirements, or at a future date you specify.

Maximizing Your CPP Benefits

Several provisions can increase your CPP retirement pension or help you qualify for benefits.

Low-Earning Years Exclusion

CPP automatically excludes up to eight years of your lowest earnings when calculating your base retirement pension. This protects your pension from years when you earned little or no income, whether due to unemployment, education, or other circumstances.

Child-Rearing Provision

If you took time off work or earned less while caring for children under age seven, the child-rearing provision can help. This provision excludes those lower-earning periods from your CPP calculation, potentially increasing your pension amount. Children must have been born after December 31, 1958, and you or your spouse must have received Canada Child Tax Benefit or Family Allowance payments during that time.

CPP Disability Benefits Protection

If you previously received CPP disability benefits, those months are automatically excluded from your retirement pension calculation. Additionally, the CPP enhancement component includes credits worth 70% of your average earnings from the six years before you became disabled, protecting your benefit value.

Pension Sharing With Spouse

You can share CPP retirement pension with your spouse or common-law partner, which can lower your combined tax burden by redistributing income more evenly. Both partners must apply for pension sharing, and it only applies to the portion of pension earned during the time you lived together.

Income-Tested Benefits: GIS And Allowances

Beyond CPP and OAS, low-income seniors may qualify for additional monthly benefits.

Guaranteed Income Supplement (GIS)

GIS provides extra monthly income to OAS recipients with low annual income. For January to March 2026, the maximum monthly GIS payment is $1,108.74, though actual amounts depend on your income and marital status.

Eligibility: You must be receiving OAS and have annual income below specific thresholds. For single seniors, the income limit is approximately $22,000 annually. For couples, combined income limits vary based on whether one or both receive OAS.

Application: You may need to apply for GIS separately, though some seniors are automatically enrolled based on their tax returns. You must file an income tax return annually to continue receiving GIS, as amounts are recalculated each July based on the previous year's income.

The Allowance

The Allowance is available to low-income Canadians aged 60 to 64 whose spouse or common-law partner receives GIS. This helps bridge the gap before you become eligible for OAS at 65. Maximum monthly amounts for 2026 are $667.41 for those whose spouse receives full OAS.

Allowance For The Survivor

Similar to the Allowance, this benefit supports low-income widowed individuals aged 60 to 64 who are not yet eligible for OAS. The maximum monthly amount is also $667.41, with eligibility based on income and residency requirements.

Tax Implications And Clawbacks

Both CPP and OAS are taxable income, but they're treated differently for tax purposes.

CPP Taxation

CPP payments are fully taxable at your marginal tax rate. You can request that Service Canada withhold federal income tax from your monthly payments to avoid owing tax when you file your return. Tax slips (T4A(P)) are issued annually.

OAS Clawback (Recovery Tax)

If your net annual income exceeds certain thresholds, you must repay some or all of your OAS pension through the OAS recovery tax, commonly called the "clawback."

For 2026, the OAS clawback begins at approximately $90,997 in net income. Above this threshold, you repay 15 cents for every dollar of additional income. At approximately $148,065 in net income, your entire OAS pension is clawed back.

Planning Strategies: To minimize OAS clawback, consider income-splitting strategies with your spouse, timing RRSP withdrawals carefully, or deferring OAS to age 70 if you're still working and have high income in your late 60s.

2026 Payment Schedule

Knowing when payments arrive helps with budgeting and financial planning.

CPP Payment Dates for 2026: January 28, February 25, March 27, April 28, May 27, June 26, July 29, August 27, September 25, October 28, November 26, December 22.

OAS Payment Dates for 2026: The same schedule applies to OAS payments, arriving near the end of each month.

Payments are typically deposited via direct deposit on the payment date. If you receive paper cheques, they may arrive slightly earlier but are dated for the official payment date.

Final Thoughts

Understanding CPP and OAS eligibility empowers you to make informed decisions about your retirement. The Canada Pension Plan rewards those who contributed during their working years, with payment amounts reflecting your contribution history. Old Age Security provides a foundation of retirement income for almost all Canadian seniors based on residency rather than work history.

Start planning early by reviewing your CPP Statement of Contributions regularly, ensuring your tax returns are filed to establish residency history, and understanding how your decisions about when to start benefits affect your lifetime income. Whether you're approaching retirement or years away, knowing these eligibility requirements helps you maximize the government pension benefits you've earned through decades of residence and work in Canada.